As the world's largest region in both geography and population, with a vast network of smallholder farmers combined with dense urban settings and food sovereignty concerns, Asia-Pacific is a hotbed of opportunity for food and agriculture technology startups.

But in 2023, downstream food delivery and restaurant startups, once the darling of the region’s agrifoodtech ecosystem, fueling tens of billions of dollars of investment, are no longer so attractive to investors.

The new star of the ecosystem is upstream innovation, reveals a new report from leading agrifoodtech venture firm and research platform AgFunder, in collaboration with the Bill & Melinda Gates Foundation, Omnivore and AgriFutures Australia.

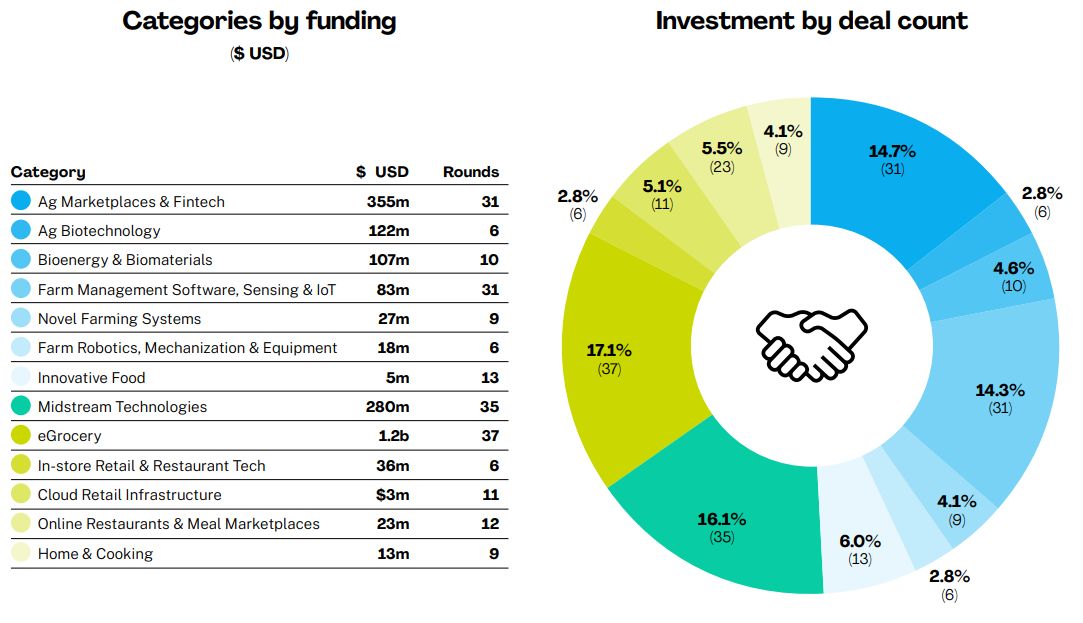

The report provides exclusive insights into the Asia-Pacific agtech landscape. In 2022, upstream agtech investment increased by 24%, surpassing downstream funding for the first time in years, benefiting smallholder farmers. India briefly overtook China in agrifoodtech investment, while Southeast Asia demonstrated significant potential with $1.7 billion in funding. Categories such as Ag Biotechnology and Innovative Food showed remarkable growth. The report also delves into stage-wise funding trends and highlights startups in key markets.

While total funding to the farm-to-fork agrifoodtech ecosystem dropped 58% year-over-year (YoY) to $6.5 billion in 2022 from the record-breaking $15.2 billion raised in 2021, investment in startups operating upstream increased 24% YoY. This increase appears to be continuing in 2023, according to preliminary data on 2023 funding flows.

This is good news for the 450 million smallholder farmers producing about 80% of the region's food. For the first time in years, upstream funding, which provides technologies to farmers and primary food producers, overtook downstream investment. The former raised $3.2 billion in 2022 versus the latter's $2.7 million, according to the report.

The Ag Biotechnology category was particularly buoyant in the Asia-Pacific region in 2022, bringing in $813 million in funding, nearly half the amount raised globally in this category in 2022. While a couple of very large deals contributed to these totals, there was also greater deal activity in this segment, which includes on-farm inputs for crop & animal agriculture," confirming investors’ growing interest in this space.

Innovative Food – the category housing the alternative protein industry – bucked the global decline in funding to the segment, with investment actually increasing year-over-year to $527 million, albeit over fewer deals.

Similarly, Farm Management Software, Sensing & IoT ($334m), Farm Robotics ($252m) and Novel Farming Systems startups ($254m), which include indoor farming and aquaculture and insect farming, brought in more funding across fewer deals.

China, meanwhile, lost its lead to India as the country attracting the most funding in 2022, likely due to the loss of downstream mega-deals that propped up China's agrifoodtech investment in 2021. India's lead looks to be short lived, however; in H1 2023, China grabbed the top spot back, raising $861 million.

The report includes deep dive sections on investment to startups in Australia, China, India, Indonesia and Southeast Asia and spotlights on startups Zetifi, Integriculture, Eratani and Tablepointer.

India has long been one of Asia’s top-funded countries for agrifoodtech. Past years have seen the country’s downstream startups — particularly those in food delivery — thrive off multi-million deals, and 2022 was no different. All of the top deals went to so-called “instant delivery” startups pedaling groceries and ready meals to consumers. However, India is also home to a growing number of upstream startups developing farmtech tools as well as marketplaces that connect the country’s many smallholder farmers more directly to both customers and farm supplies.

Some key insights include:

- Asia-Pacific agrifoodtech startups raised $6.4 billion in 2022, down 56% from the record-breaking $15.2 billion raised in 2021. But upstream investment increased 24% year-over-year to $3.2 billion.

- In the first half of 2023, some $2.6 billion has closed, a nearly 50% decline compared to H1 2022. But again upstream startups gathered more funding than in the same period in 2022, reaching $1.7 billion, a 1.6% year-over-year increase.

- In H1 2023, Chinese startups have raised the most funding, with $861 million. India ($712 million) is next, followed by Hong Kong ($400 million) and Australia ($146 million).

- Ag Biotechnology was the biggest upstream category in 2022, raising $813 million. China’s Zhongxin Breeding, a startup in this category, secured the year’s largest deal with its $327 million seed round.

- Downstream's biggest category was once again eGrocery, which raised $1.6 billion in funding. India eGrocery startup Blinkit's $150 million raise was the largest downstream deal.

- Startups in Midstream Technologies raised $620 million in 2022, with big checks going to India's Waycool and China's Mojia Biotech.

- Despite fewer deals, dollar investment in 2022 increased year-over-year in Innovative Foods; Ag Biotech; Farm Management, Software Sensing & IoT; Novel Farming Systems; and Farm Robotics.

- India ($2.3 billion) overtook China ($1.3 billion) in 2022 as the region's top country for agrifoodtech investment, followed by Indonesia ($716 million) and South Korea ($461 million).

- Southeast Asia startups funding reached $1.7 billion in 2022.

- Australian agrifoodtech startups closed 38 deals in 2022, totaling $316 million and investment momentum appears to have been maintained in H1 2023, with $146 million closed.

- Japan ranked at #8 in 2022, bringing in $211 million across 43 deals.

- Debt, early and growth-stage deals numbers have increased steadily since 2018; late-stage funding declined from 2021.

This report was produced by AgFunder in collaboration with the Bill & Melinda Gates Foundation, Omnivore and AgriFutures Australia.

About AgFunder

AgFunder is one of the world’s most active foodtech and agtech VCs. We’re rethinking venture capital for the 21st century. Born in Silicon Valley in 2013, we use technology, media and our global network to invest in and support transformational founders and technologies. With the world’s only truly global agrifoodtech investment portfolio, we’ve invested in more than 60 companies across six continents.

About AgFunderNews

AgFunderNews reports on the evolution of the global food and agriculture system. By going beyond the headlines, we analyze the people, companies and technologies aiming to improve human and planetary health. A multimedia publication with a subscriber-base of 90,000+, AgFunderNews is a division of AgFunder Inc.

About AgriFutures growAG. and evokeAG

AgriFutures growAG.is the gateway to Australia’s agrifood innovation system. AgriFutures evokeAG. is Asia Pacific’s premier agrifoodtech event.

About Omnivore

Omnivore is a venture capital firm based in India and is the only impact investor in South Asia focused entirely on agriculture and food systems. Since 2011, Omnivore has backed over 40 agritech startups. Every day, Omnivore portfolio companies drive agricultural prosperity and transform food systems across India, making farming more profitable, resilient, and sustainable.

/articles/empowering-indian-agriculture-upstream-startups-and-farmtech-innovations